0 Comments

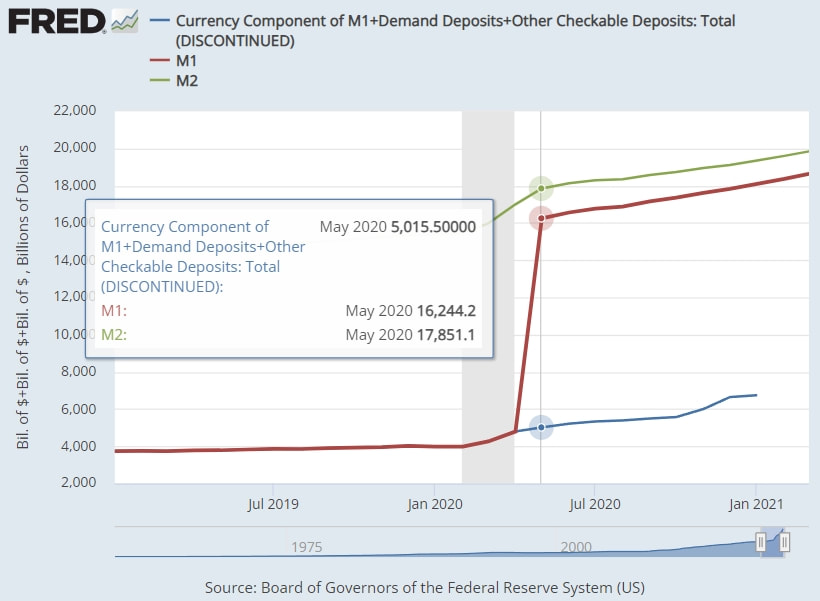

Before April 24, 2020, savings accounts were not part of M1. Limitations in the number of transfers from savings deposits made savings accounts less liquid than M1. M1 consisted of currency, demand deposits, and other highly liquid accounts called “other checkable deposits” (OCDs). An example of OCDs are the demand deposits at thrifts. But the limitation on the number of these transfers was lifted on April 24 as an amendment to Regulation D, which specifies how banks must classify deposit accounts. Savings deposits are now just as liquid and convenient as currency, demand deposits, and OCDs. To reflect this fact, savings deposits are now included in M1 (other liquid deposits). 在2020年4月24日之前,儲蓄帳戶並不屬於M1貨幣供給的一部分。由於儲蓄存款轉帳次數的限制,使得儲蓄帳戶比M1貨幣供給更不具流動性。M1貨幣供給包括貨幣、活期存款,以及其他高流動性帳戶,稱為「其他支票存款」(Other Checkable Deposits, OCDs)。其中一個OCD的例子是儲蓄機構的活期存款。 然而,這些轉帳次數的限制在4月24日被解除,作為對「D規例」的修正。該規例規定了銀行如何對存款帳戶進行分類。現在,儲蓄存款與貨幣、活期存款和OCD一樣具有流動性和便利性。為了反映這一事實,儲蓄存款現在被納入M1貨幣供給(其他流動存款)的範疇中。 親愛的聽眾:

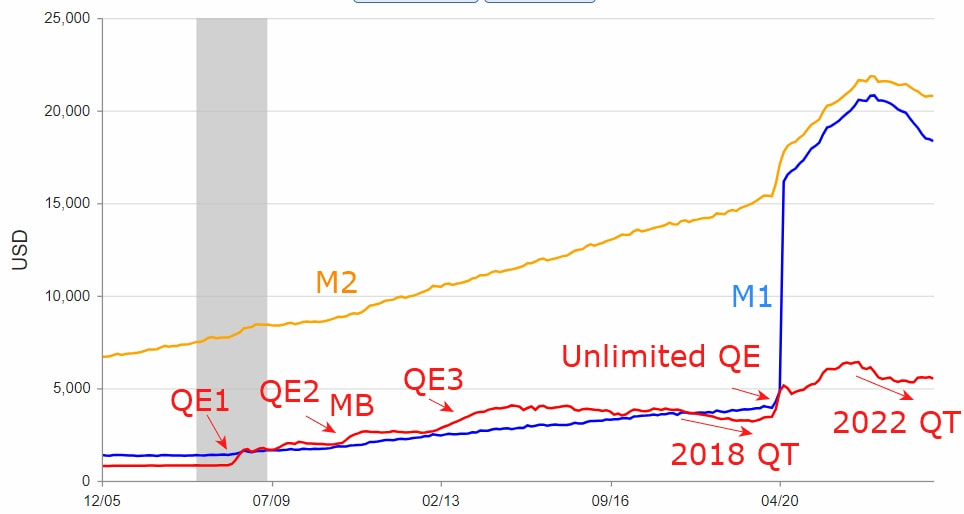

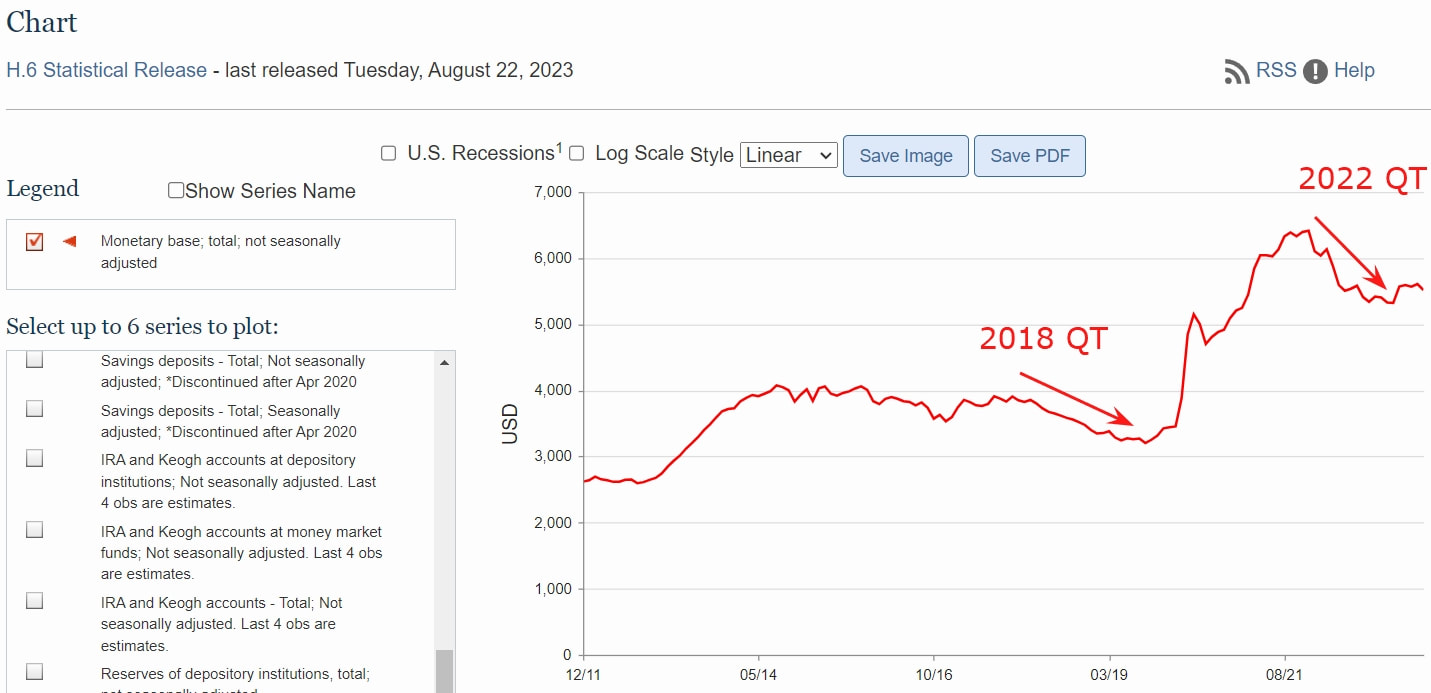

於8月13日的Podcast中,我們深入探討了利率倒掛(Inverted Yield Curve)是否仍然具有有效預測經濟衰退的能力。同時,節目中也介紹了美聯儲(FED)正在引入全新的貨幣政策工具,即準備金利率(Interest Rate on Reserve Balances, IORB)。 Podcast引述了瑞士銀行的看法,雖然美聯儲將政策利率目標區間的上限提高至5.5% (創下22年來的新高),然而目前的政策限制性仍然相對溫和。無論情況如何,這些政策並不足以導致經濟進入衰退。就連摩根大通都調整了其對於衰退的預測。 2020年3月26日,美國將法定存款準備金率降至0%。隨後,在2021年6月2日,美聯儲宣布取消IORR和IOER,將這些工具合併為準備金利率(IORB)。針對美聯儲政策工具的革命性改變,我們在Podcast中進行了推測,自2008年金融危機後,目前M2貨幣供給量可能會比僅僅單關注利率本身,對於股市的影響更顯著。 https://www.federalreserve.gov/newsevents/pressreleases/bcreg20210602a.htm (2021/6/2) https://fred.stlouisfed.org/series/IORB#0 (IORB) 最後分享一下季凡投資歷程:2019年至2023年間的變化,開始槓桿持有資產,2015年中國股災期間,美國M2貨幣供給卻上升,進行槓桿加碼持有股票。在2018年美國縮表並伴隨M2貨幣供給增加時,再次加碼(但無槓桿)持有股票。而在2022年美國縮表,但M2貨幣供給下降的情況下,增加防禦性資產。 APcore服務團隊敬上 |

|

|||||||||