|

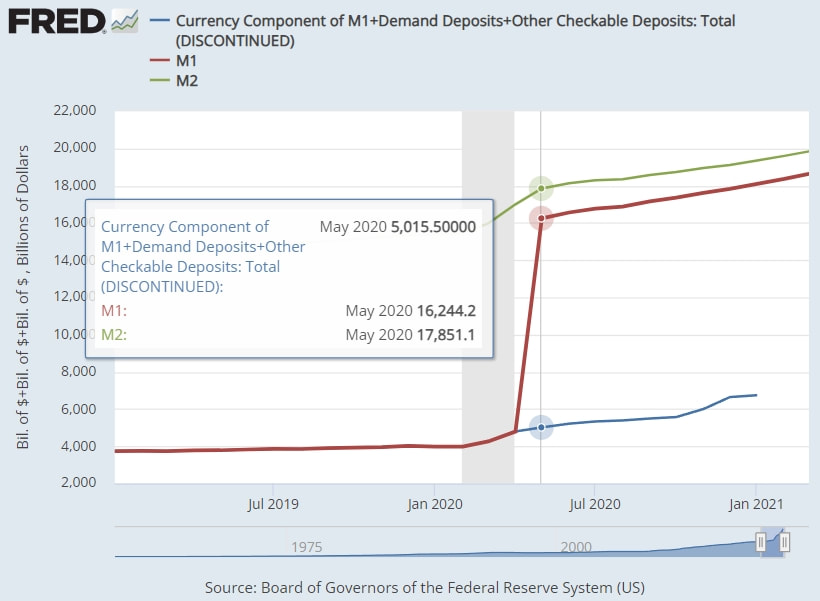

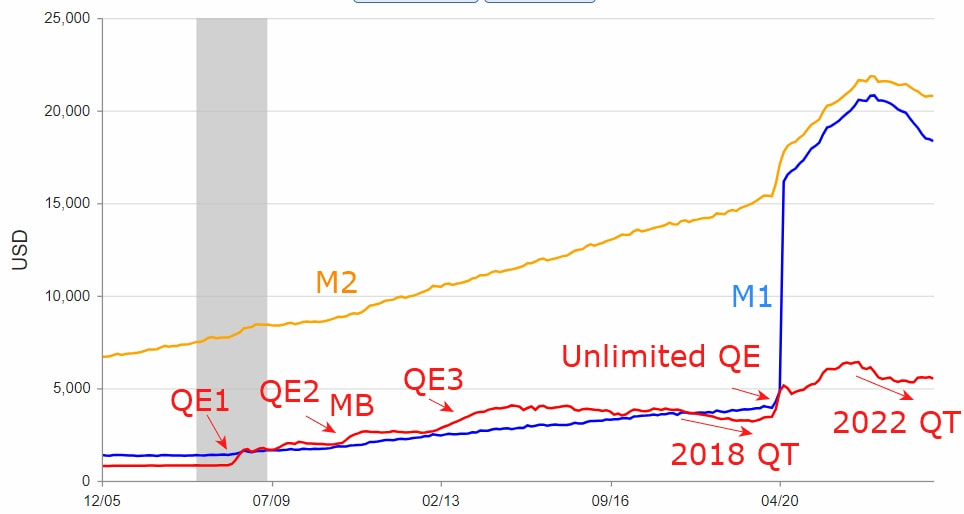

Before April 24, 2020, savings accounts were not part of M1. Limitations in the number of transfers from savings deposits made savings accounts less liquid than M1. M1 consisted of currency, demand deposits, and other highly liquid accounts called “other checkable deposits” (OCDs). An example of OCDs are the demand deposits at thrifts. But the limitation on the number of these transfers was lifted on April 24 as an amendment to Regulation D, which specifies how banks must classify deposit accounts. Savings deposits are now just as liquid and convenient as currency, demand deposits, and OCDs. To reflect this fact, savings deposits are now included in M1 (other liquid deposits). 在2020年4月24日之前,儲蓄帳戶並不屬於M1貨幣供給的一部分。由於儲蓄存款轉帳次數的限制,使得儲蓄帳戶比M1貨幣供給更不具流動性。M1貨幣供給包括貨幣、活期存款,以及其他高流動性帳戶,稱為「其他支票存款」(Other Checkable Deposits, OCDs)。其中一個OCD的例子是儲蓄機構的活期存款。 然而,這些轉帳次數的限制在4月24日被解除,作為對「D規例」的修正。該規例規定了銀行如何對存款帳戶進行分類。現在,儲蓄存款與貨幣、活期存款和OCD一樣具有流動性和便利性。為了反映這一事實,儲蓄存款現在被納入M1貨幣供給(其他流動存款)的範疇中。

0 Comments

Leave a Reply. |

|